Update February 23, 2026

A recent ruling by the U.S. Supreme Court has determined that tariffs imposed under the International Emergency Economic Powers Act (IEEPA) are unlawful.

What does this mean?

- CBP will cease collecting IEEPA Reciprocal Tariffs as of midnight on Tuesday, February 24, 2026.

- These country-specific tariffs have been removed from the Chit Chats platform as of approximately 10:30 am ET on Monday, February 23rd, 2026.

- Additional Tariffs (Sections 232 and 301) are still in effect.

At the same time, the U.S. Administration has announced that they will impose a 10% tariff on all imports regardless of Country of Origin, as of 12:01 am ET on Tuesday, February 24, 2026, using Section 122 of the Trade Act of 1974.

- The Presidential Proclamation and Fact Sheet were published on February 20th with a rate of 10%, but the President has since stated it may be raised to 15%.

As noted in the Presidential Proclamation, the same exemptions for IEEPA tariffs apply.

- This includes, but is not limited to, Informational Materials, items subject to Section 232 tariffs, and certain electronics.

- Items eligible for preferential tariff treatment under CUSMA are also exempt from this additional tariff.

At this time, specific conditions for EU countries, Japan, Korea, and Switzerland where items would be subject to a flat 15% if the base duty rate is below 15% or only the base duty rate if the rate is above 15% are not applicable to Section 122 tariffs.

How this impacts you

- Shipments that have been created on the Chit Chats platform but have yet to cross the US border will have their tariff fees recalculated where applicable.

- In some cases this will mean slightly higher tariff fees, in other cases, it will mean the difference in overpaid tariff fees will be refunded to your account.

- We are awaiting further guidance from our broker on the timing of such recalculations.

- At this time, the ruling does not provide guidance regarding refunds for previously paid IEEPA Reciprocal tariffs. Additional clarification from U.S. Customs and Border Protection (CBP) is still required.

We are actively monitoring the situation and will share updates as more information becomes available.

In the meantime, tariffs will continue to be collected, as they remain required for shipments entering the U.S.

Update February 18, 2026

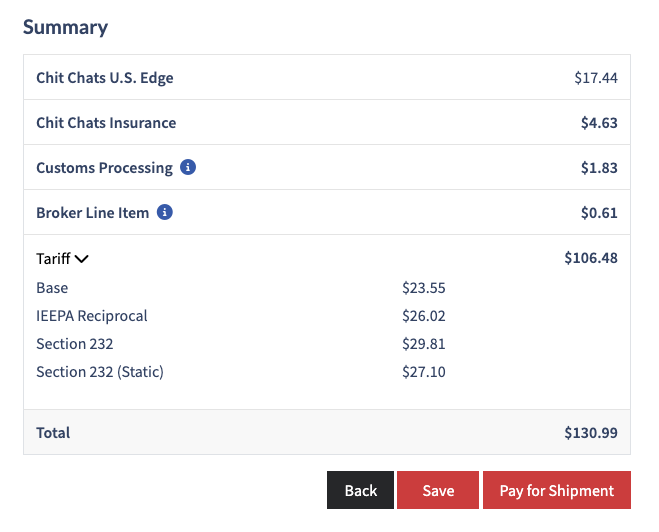

When purchasing a shipment, you can now view a detailed breakdown of your total tariff fees, showing exactly how each charge is calculated. This information is also accessible from the right-hand menu bar for easy reference.

You may see one or more of the following tariff types (this list is not exhaustive):

- Base: The standard tariff rate determined by the applicable HTS code.

- IEEPA Reciprocal: Additional (reciprocal) duties imposed by the U.S. administration on goods from certain foreign countries.

- Section 232: A tariff calculated based on the metal content of the item.

- Section 232 (Static): A tariff applied to the total value of the item, regardless of metal content percentage, as determined by the HTS code.

Please note: A single item will never be subject to both Section 232 and Section 232 (Static). However, both may appear within the same shipment if it contains multiple items with different tariff applications.

This update is intended to reduce confusion and provide greater clarity around tariff charges. If you have any questions, please visit our newly updated support article.

Update January 29, 2026

The previously announced Section 232 feature on our platform will be available starting Thursday, Feburary 5, 2026.

This will affect how tariffs are calculated for goods that are subject to Section 232 (Steel, Aluminum, and Copper) tariffs.

Notice

This tariff currently applies only to steel, iron, aluminum, and copper. Other metallic materials, such as titanium, are not included at this time; however, this is subject to change.

Shipments created before the implementation of this feature can still be dropped off at a Chit Chats location and will not experience any delays. There is no need to recreate postage.

CUSMA does not apply to shipments that are subject to section 232 tariffs. If the Country of Origin for the HTS code is the U.S., the shipment will not be subject to this tariff. However, we are currently experiencing a bug that still requires you to enter percentage composition values. Despite this, no tariff fees will be applied.

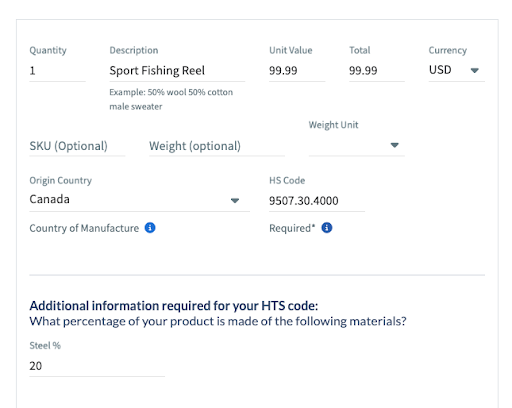

For products with HTS codes affected by Section 232 tariffs (nuts, bolts, sewing needles, etc), the platform will automatically prompt users to indicate what percentage of the item is composed of steel, aluminum, and/or copper as shown below. This will ensure the correct tariff rate is applied.

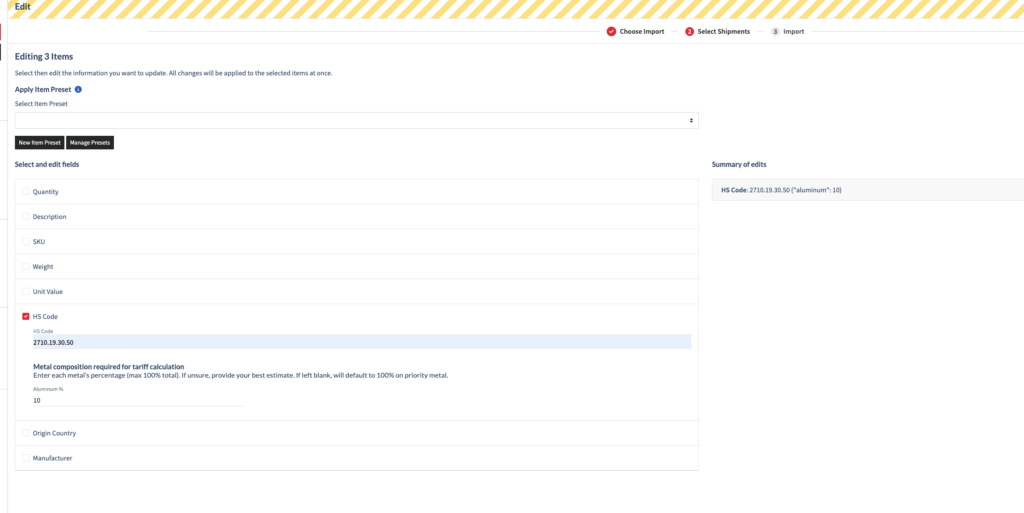

For those who import Store Integrations, we recommend creating shipment item presets to capture this information. You can edit the metal content of your items during import via the Edit Order Item tool, under the HS Code option:

⚠️For those using our API or importing using our CSV template, please note that both will be updated during launch. Please ensure you update them accordingly to continue importing without any issues.

CSV Template – new columns are added to enter a whole number for the percentage:

- item_steel_percentage

- item_aluminum_percentage

- item_copper_percentage

How do I know whether or not products will be subject to these tariffs?

HTS codes covered under Section 232 are listed in the HTSUS Subchapter Notes for Chapter 99. A condensed version of this information can be found here.

Common items:

- Nails, screws, nuts, bolts

- Cookware and tableware

- Sewing needles and springs

- Staples

- Sports equipment (skis, tennis rackets, baseball bats, etc.)

- Electronic and mechanical parts (computer components, etc.)

How can I determine the percentage of steel, aluminum, or copper?

- The product’s manufacturer will have the most accurate information.

- If the manufacturer is not available to be contacted, you may estimate the percentage by comparing similar products. However, you are responsible for ensuring the accuracy of the declared material content.

- Some items classified under affected HTS codes may contain no metal. If the item contains no steel, aluminum, or copper, you may declare 0%.

Note: The failure to disclose the metal content in products may result in a flat 50% tariff applied to your shipment item(s).

For more information, please visit our recently updated tariff support article.

Update January 14, 2026

As a part of our plan for 2026, we are happy to announce that it is now possible to ship coffee and tea using our services to the U.S.!

What does this mean?

Our platform allows the creation of U.S. postage for HTS codes that fall under the coffee and tea category. This includes, but is not limited to:

- Coffee beans (roasted and unroasted)

- Tea leaves

Key Points

- Packaging must be professional and retail-ready. Informal packaging (e.g., ziplock bags) will be rejected by customs.

- The exact manufacturer must be identified; you cannot use yourself as the manufacturer if it is a resale (e.g. selling Starbucks coffee beans).

- Roasting coffee beans is considered a substantial transformation, and the country in which it was roasted will be considered the Country of Origin (COO).

- Products making medical or health claims (e.g., diet teas) are not permitted.

- Shipments must be for personal consumption only, not for delivery to other businesses.

- U.S. shipments containing an HTS code classified as coffee or tea will include an additional fee titled FDA Prior Notice. This is a flat fee of $0.50 USD per unique HTS code related to coffee or tea. This fee is necessary for a smooth border crossing for your shipment.

- *Please note that this fee is subject to change.

- There are no documentation changes or updates; however, consider the following:

- Shipments over $300 USD require an invoice

- Products must include nutritional information on the packaging or have it available on your website

For more information on labeling these products, please visit the following FDA website.

In addition, you may visit our new support article.

Restricted Countries of Origin – click to expand

Due to ongoing political tensions, the United States enforces sanctions that restrict imports from certain Countries of Origin. As a result, Chit Chats is unable to accommodate any products containing shipments originating from affected countries.

At this time, this includes products with a Country of Origin of:

- Cuba

- Palestine

*Please note that this list is subject to change based on evolving political circumstances and future U.S. policies.

Any shipments containing products from the above origins are not eligible for any U.S. postage through Chit Chats.

Important Reminders

No manufacturer info? Chit Chats International Tracked is an alternate solution for you. Read more

We are still not accepting Amazon FBA shipments – this was temporarily suspended at the end of August. If we enable acceptance of Amazon FBA shipments we will update here.

CUSMA

Submit for approval and duty-free treatment if the country of origin is Canada, U.S., or Mexico and you meet CUSMA requirements (Rules of Origin are met). If the HTS code indicates the S/S+ indicator or it shows Free in the General Duty column on the offical US site. Be sure to check that your HTS code is valid (appears on the US site).

- Simply provide the country of origin, product description and 10 digit HTS code for approval

- Once approved to see duty-free enter the same COO and HTS

- If you had previously created SKUs that were approved be sure to enter the HTS and COO that was approved to continue seeing duty-free

Incorrect or missing information – click to learn more

Common reasons for delays result from incorrect, vague or missing information – we’ve made adjustments to catch any missing information at time of postage creation.

U.S. Customs Border and Protection has implemented automated enforcement of package descriptions. This means you must ensure that all shipment descriptions are detailed. For example t-shirt is not acceptable but rather men’s cotton t-shirt. If your shipment does not have detailed descriptions this will cause your package to be rejected.

What You Can Do

- 👉 Ensure you provide a valid 10 digit HTS code

- 👉 Provide accurate and detailed shipment descriptions. Find examples in our previous blog

- 👉 Ensure manufacturer information is valid and matches the country of origin

- I.e. Country of origin is China – the manufacturer address MUST be a Chinese address

- Entering placeholder text (Unknown, N/A, etc.) will result in shipments being rejected and further delays

Update on Informational Material – Oct 22, 2025 – click to see details

Shipments classified as informational materials are once again exempt from reciprocal tariffs, regardless of origin or CUSMA certification. For existing shipments, refresh rates to view updated tariff treatment. For details, see the CBP FAQ definition of informational materials here.

Section 301 Tariffs on goods from China

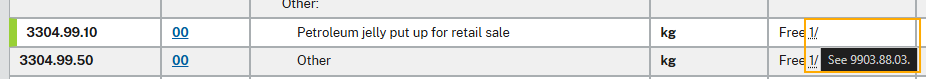

Depending on the product’s HTS code, an additional tariff for products from China may apply. These can be identified by hovering over the ‘1/’ in the HTS Schedule, and looking up the HTS Code provided in the tool tip, as pictured below:

These additional tariffs are considered ‘Section 301 Tariffs’ and can range from 7.5% to 25%, depending on the HTS Code. More information can be found on the Office of the United States Trade Representative website.

RESOURCE HUB – Find link by clicking for more details

With so much information find key topics below that will provide additional resources and FAQs to help you navigate these changes.

US Shipping Is Changing — And We’re All Feeling It

To our Chit Chats family,

Lately, everything is changing — and fast. There are new rules and regulations, which are demanding the creation of new systems. It’s been a lot to keep up with and you’re not alone in feeling overwhelmed.

Behind the scenes, our team is collaborating with our broker to develop the system and working closely with US Customs to ensure our Canadian ecommerce sellers have the information they need to remain compliant.

Not everything is in our control, Chit Chats is adapting as quickly as possible to support you through these transitions. The removal of the de minimis threshold has disrupted shipping in unprecedented ways. Not only are shipments being delayed and rejected but the new requirements are impacting your bottom line.

What We’re Doing to Support You

We’re committed to leveraging our network to mitigate risks where we can, minimize the impact to you where possible. The learning curve is steep for all of us but we’re working around the clock to troubleshoot, communicate and provide solutions to help you continue to ship.

We understand shipping is an integral part of your business but we also know your client experience matters. Whether you’re a solo Etsy artisan, a seasoned eBay seller, or a growing online brand, we know these changes are creating real challenges.

🇨🇦 Chit Chats Puts Canada First

This isn’t the first time Canadian businesses have faced cross-border shipping challenges. In fact helping Canadian eCommerce sellers succeed is at the heart of what we do. Back in 2001, when our founder Derek Nolan saw firsthand how hard it was for small businesses to ship affordably and reliably from Canada and compete globally. That mission has never changed.

Moving Forward Together

We know this is a tough moment, but we want you to know we’re in it with you. Our commitment remains the same: to find solutions that empower Canadian businesses to thrive, no matter how the rules shift. Thank you for trusting us through this journey; we’ll continue to keep you informed and supported every step of the way.

FAQs

Postage Is DDU (duties unpaid) no longer available with Chit Chats? – click for answer

There are no DDU options at this time. We understand that many sellers prefer to have duties collected at the time of delivery from the recipient and our team is exploring if we can provide a solution. There is no timeline if and when a DDU solution will be available but we will update all clients if this changes.

For Chit Chats Edge and Chit Chats Select – is this a postal or non-postal service?

Due to our method of entry into the US, both Chit Chats U.S. Edge and U.S. Select are non-postal services. Other postages partnered with Canada Post and PostNL follow under postal services. You will not be required to pay the $200 ad valorem fee, however you will be expected to pay a tariff fee based on the item(s) declared.

If I ship with USPS Media Mail will this still be available?

USPS Media Mail is available through our DDP (duties paid) option. The country of origin, valid HTS code, and manufacturer information must be declared in order to obtain rates.

Will I need to provide a manufacturer address for books when I don’t have it?

- To access DDP (duties paid) postage options you are required to provide manufacturer information. If it cannot be provided our DDU options can be an alternative as you only require the country of origin and a valid HTS code.