Shipping internationally often feels like a daunting task—especially for small businesses where every sale and satisfied customer counts. From navigating customs to managing higher costs and delivery times, there’s a lot to consider when sending packages across borders. But don’t worry—Chit Chats is here to help with this comprehensive guide! Whether you’re just getting started with international shipping or looking to improve your current process, we have compiled a list of essential tips to make your global deliveries stress-free and successful.

Note: This guide focuses on international shipping. If you’re looking to ship to the United States, please refer to our dedicated U.S. shipping guide for tailored tips and information.

We’ll save you the wait—here are the key factors to keep in mind when shipping internationally:

- Accurate Descriptions

- Recipient Information

- Packaging & Prohibited Items

- Documentation

- Costs & Carriers

Feel free to click on the section that interests you most, or keep reading for a full overview of everything you need to know to ship confidently across borders.

Accurate Descriptions

As with all shipments, providing detailed and accurate descriptions is crucial for international shipments. Vague or incomplete item descriptions can trigger customs inspections, which may lead to delays or even refusals.

To help ensure your shipment clears customs smoothly, always include:

- The type of product

- The material or composition

- The intended use (if relevant)

- Key details such as color

For example, instead of writing “shirt,” a more accurate description would be:

“1 black 100% cotton men’s t-shirt”

This level of specificity helps customs authorities identify the contents of your parcel quickly and accurately, reducing the chance of your shipment being flagged or held for additional inspection.

Recipient Information

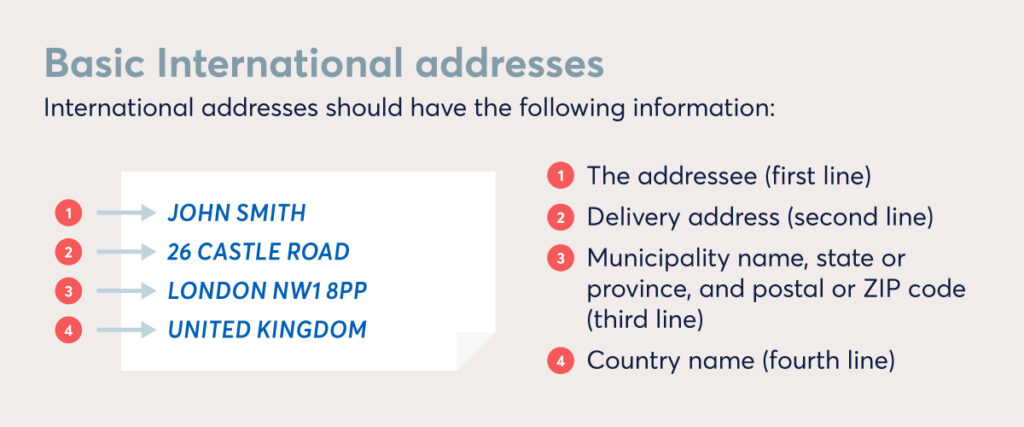

Formatting Addresses

Many countries around the world follow different conventions when it comes to address formatting. Some do not use postal codes, others may not include street numbers, and there are various other unique regional nuances.

For instance, Hong Kong, although a part of China, is a special administrative region of the country and operates very differently from mainland China; this includes not using postal codes at all. In Germany, the postal code appears before the city name, while in Japan, addresses are organized by block and building number instead of a street name and number.

Navigating the unique address formats of different countries can be tricky, especially when shipping to a new international destination.

Since it’s nearly impossible to know every nuance, it’s always best to do a bit of research ahead of time. A helpful resource is the Universal Postal Union’s guide on postal addressing systems. Simplify follow these instructions:

- Under the section: Postal Addressing Systems (PAS) > Postal addressing systems in member countries > Select country from drop-down menu. > Click download (will open in new tab)

When formatting international addresses, always include all key details—such as apartment or unit numbers where applicable. Also, consider the language and script requirements of your chosen carrier. Many carriers prefer addresses in English or Latin script (the English alphabet), especially when operating in a global context. For example, our partner for Chit Chats International Tracked requires addresses to be in English and Latin characters.

Finally, if your carrier offers an address auto-verification tool, take advantage of it. And when in doubt, confirm the full address directly with your customer—the recipient knows best how their local address should be formatted.

Additional Recipient Information

When it comes to international shipping, accuracy is everything—especially when sending packages to faraway destinations. Getting the recipient’s (the person receiving the package) information right the first time helps ensure a smooth delivery with minimal delays or returns.

One of the best ways to set your shipment up for success is to include as much recipient information as possible. This means not only the full name and address, but also a valid phone number and email address. Why? Because most international postal services will attempt delivery once, and if the recipient isn’t available, the package is typically redirected to a local post office for pickup.

At that point, the local carrier will try to notify the recipient—often by phone, email, or both. But here’s the catch: the pickup window is usually short. If the recipient doesn’t collect the package in time, it may be returned or even discarded, depending on policies.

Providing complete contact details allows the recipient to:

- Be promptly notified about pickup instructions

- Reach out to their local post office for redelivery

- Inquire about extending the pickup window, if allowed

In some countries, this contact information isn’t just helpful—it’s required to process the shipment. That’s why it’s best practice to always request this information from your international customers.

If you sell through platforms like eBay, Shopify, or Etsy, this data is usually collected at checkout, making it easy to include when creating your shipments.

Packaging & Prohibited Items

Packaging

You can find more general packaging tips here.

No matter where you’re shipping, there are universal best practices for packaging and labeling your shipments. Always use new, sturdy boxes or envelopes to protect your items during transit. Labels should be placed on a flat surface and be easily scannable to ensure smooth processing throughout the network.

That said, some international destinations have specific packaging restrictions you’ll need to be aware of. For instance, Brazil prohibits the use of clear or transparent packaging. This rule is in place to reduce theft, as being able to see the package contents can make them a target.

Taking the time to research country-specific packaging regulations can help you avoid delivery delays or even disposed shipments.

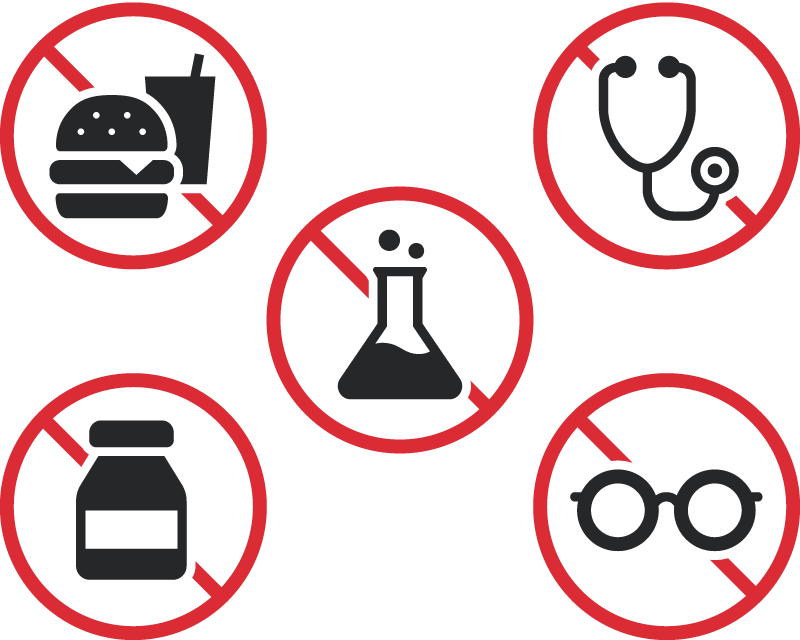

Prohibited Items

Air transport is the primary mode used for most international parcels due to its speed and efficiency. However, with air transportation comes stricter regulations to ensure the safety, such as adhering to TSA regulations. One key restriction is the limit on flammable and hazardous items permitted onboard aircrafts. For instance, flammable products, aerosols, and lithium batteries are heavily regulated or entirely banned depending on the carrier.

For example, Chit Chats International Tracked limits the number of batteries or cells a parcel may contain. Only new batteries, still in their original manufacturer packaging, are permitted. Used or damaged batteries are strictly prohibited.

Beyond transportation restrictions, countries may also enforce specific import bans on certain types of goods for safety or regulatory reasons. An example of such is that Australia requires jewelry only to be sent as an insured parcel, or France requires books in the French language printed abroad to have the names of the publisher and printer shown as prescribed by the French copyright laws.

To avoid delays, fines, or returned shipments, it’s always a good idea to check both your carrier’s list of restricted and prohibited items and the import guidelines of the destination country.

Documentation

Invoices

Declaring the correct value of your international shipments is essential for smooth customs clearance. International parcels may pass through multiple customs checkpoints depending on their route, and missing or inaccurate documentation can lead to delays, fines, or even returned shipments.

To avoid these issues, always include a detailed invoice with your shipment. This document serves as proof of the transaction and allows customs officers to verify the contents and declared value. A proper invoice should include the following key information:

- Shipping address

- Billing address

- Item(s) sold

- Amount paid (must be in retail value)

- Method of Payment (i.e. credit card, cash, cheque, etc.)

This information helps customs officials assess the contents and determine if any duties or taxes apply (if applicable). It also serves as a cross-reference with the customs declaration and carrier data.

We strongly recommend attaching the invoice to the outside of the package, ideally in a clear pouch. This makes it easily accessible should customs agents need to inspect the shipment without opening the package.

Tax Reference Numbers and Country Guidelines

Optional Tax Reference Numbers

As mentioned above, customs duties and taxes may apply to international shipments depending on their destination. To help streamline customs clearance and avoid surprise charges for your customers, some countries, specifically in Europe, offer the option to prepay these fees through the use of tax reference numbers.

These reference numbers indicate that duties and taxes were paid in advance by the sender (you, the seller), so the recipient won’t be charged again at the time of delivery. This can significantly improve the customer experience and reduce the likelihood of refused or disposed packages.

Examples in Europe:

- European Union (EU): IOSS – Import One-Stop Shop

- United Kingdom (U.K.): VAT ID – Value Added Tax Identification Number

- Norway: VOEC – VAT on E-Commerce

These systems are optional, but when used correctly and within their value thresholds, they can exempt recipients from paying additional import charges.

- Addresses in the UK: $220 CAD*

- Addresses in the EU: $215 CAD*

- Addresses in Norway: $380 CAD*

*Subject to change with exchange rates. Always verify thresholds with the destination country’s latest guidelines.

If a shipment’s declared value exceeds these limits, the recipient will still be responsible for paying duties and taxes upon delivery—even if a tax reference number is provided.

Mandatory Tax Reference Numbers

In contrast to the optional systems above, some countries require tax identification numbers for all incoming shipments, regardless of value or whether duties have been prepaid. Without them, your shipment may be delayed or rejected outright.

Examples include:

- Brazil: Requires the CPF or CNPJ number (individual or business tax ID)

- South Korea: Requires the PCCC (Personal Customs Clearance Code)

- Not required if less than $150 USD

We strongly recommend researching destination-specific import regulations before shipping, particularly if you’re expanding into a new international market. Country customs authorities and postal services often publish updated requirements online.

HS Codes

When shipping internationally, most carriers require you to include Harmonized System (HS) codes to identify the goods in your shipment. These standardized numerical codes are used by customs authorities worldwide to classify products for duties, taxes, and import/export regulations.

Finding the right HS code can be a challenge. To help, here are some trusted resources you can use:

Be sure to choose the code that most accurately reflects the item you are shipping. If unsure, consult multiple sources or contact the customs of the country of destination directly.

Other Country Specific Guidelines

In addition to HS codes, many international destinations have product-specific safety or compliance requirements. These regulations are often in place to protect consumer safety and ensure product quality.

For example:

- In the European Union (EU), you may need to comply with the General Product Safety Regulations (GPSR). These regulations apply to many consumer goods and ensure that products meet EU safety standards.

- If you’re not the manufacturer, you’re typically not responsible for proving compliance—but you should still confirm that your supplier or manufacturer is compliant.

- For more on the GPSR, refer to our support article here.

Keep in mind that the EU is not the only region with product compliance rules. Other regions may have similar requirements related to:

- Consumer security regulations

- Product certifications

- And more

Costs and Carriers

Why is International Shipping so Expensive?

International shipping is often the most costly type of shipping—and for good reason. One of the primary drivers is the high fuel cost associated with long-distance transportation, especially when using air freight, the fastest but most expensive shipping method.

But fuel isn’t the only factor. Several other variables contribute to the overall price:

- Shipments often change hands multiple times—between carriers, customs agents, and local carriers—each adding handling fees.

- Many countries apply import taxes and duties that increase the total cost of shipping.

- The farther the destination, especially to remote or rural areas, the higher the cost.

- Extra screening for international parcels, particularly for air transport, adds to processing costs.

- Coordinating international deliveries requires more logistics work, which increases the overall cost.

International logistics is intricate, and the cost of shipping reflects the coordination and effort required to move parcels across borders safely and efficiently.

💡 Tip: To help manage these costs, compare your carrier options. Many offer different service levels such as tracked vs. untracked, and varying levels of insurance coverage. These features can make a big difference depending on your needs and the value of your shipments.

Why Chit Chats Could Be the Right Fit for You

While the cheapest option isn’t always the best, Chit Chats may be the perfect balance of affordability and reliability for your international shipping needs.

We offer:

- Low-cost postage

- Insurance starting at $1.99 CAD for international destinations

- Delivery estimates as fast as 5 business days

- A trusted international partner carrier to ensure reliable and secure delivery

Want to see how we stack up against the competition? Check out our price comparison blog here.

We are here to help guide you through the complicated process of international shipping!

Start saving with Chit Chats today!

No hidden monthly fees. Unbeatable prices. More than 20 million packages delivered.