Update Aug 25, 2021

Requirements for Recipient Phone Numbers

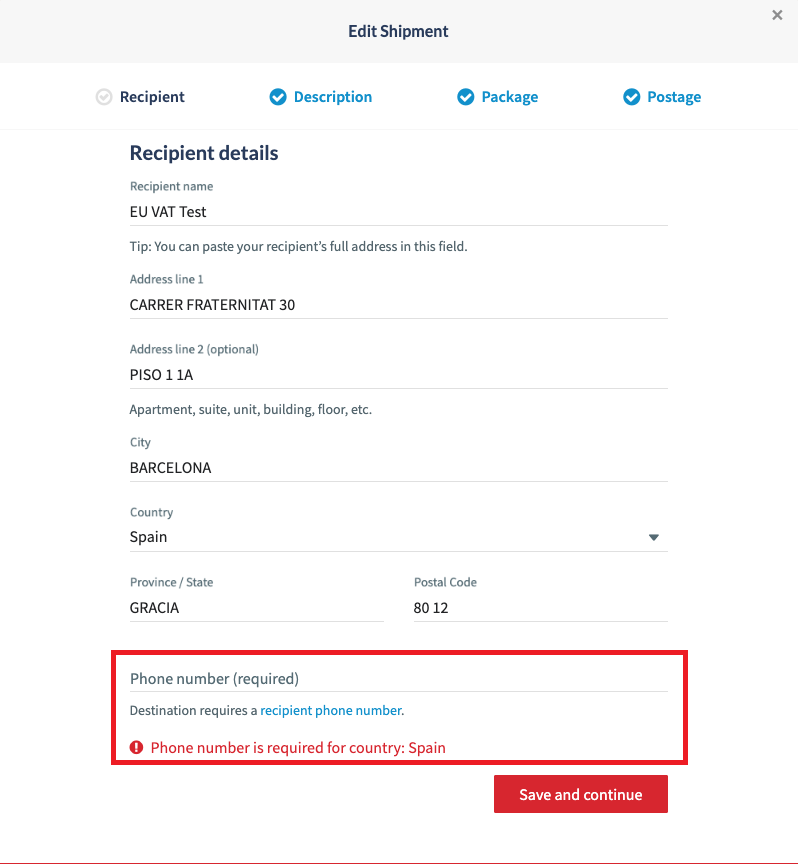

As a part of new customs procedures for collecting VAT on shipments, recipient phone numbers are required for all shipments destined to an EU member country (see the full list of countries in the post that follows).

Beginning July 1, you will be required to provide your recipient’s phone number when creating shipments destined to the EU.

If you import your shipments using the Chit Chats API or Chit Chats CSV, the recipient phone number must be entered for the to_phone field or column H. Not including this information can cause your entire import to fail. You will then need to update the phone number information and attempt to import your shipments again.

A failure to provide an accurate recipient phone number may result in additional customs delays, fees and the potential for non-delivery (meaning your shipment may either be returned to sender or destroyed).

We understand that these updates come at very short notice and we ask for your patience while the shipping industry at large works together to adapt to these changes.

IOSS Number Requirements

IOSS numbers will be provided to the sellers of online marketplaces such as Etsy and Amazon for their shipments beginning July 1. Additionally, it will be the responsibility of the seller to provide this information to their shipping partners for electronic submission to customs. A failure to do so may result in issues with customs clearance such as additional VAT or customs fees.

New Field for IOSS Numbers

To accommodate the EU VAT requirement for IOSS numbers we’ve added a new Customs Tax Reference Number field when creating shipments in your Chit Chats account.

When describing the contents of your international shipment, you’ll be asked to enter an optional Customs Tax Reference Number. This field should be used to include the IOSS number(s) for your shipments destined to the EU. It can also be used to include other customs reference numbers where needed.

If you import your shipments using the Chit Chats API or the Chit Chats CSV this new field will be labelled vat_reference (column Z).

If you import your shipments using one of our store integrations, several of the online marketplaces we integrate with do not pass along IOSS numbers at this time. This means that you will need to add the IOSS number manually or by using our bulk editing and presets features.

We are still working with our partners to streamline these processes for our clients. We truly appreciate your patience and understanding through this transition.

Update June 28, 2021

We have received further updates from our partners in the industry regarding the upcoming changes for EU shipments. Specifically, there are additional shipment information requirements from EU customs agencies that you need to be aware of for your shipments. However, there are still many unknowns at this time. We continue to work closely with each of our international partners for the latest information about your shipments.

As a result of both Brexit and UPU changes, the European Union (EU) is now restructuring how imported shipments work. In January of this year changes to VAT for goods sold to the UK were implemented. Now changes will also apply to all EU shipments. Previously, all shipments under €150 were exempt from Value Added Tax (VAT). However starting July 1, 2021, VAT will now apply to all shipments, regardless of their value.

To help streamline this change, all members of the EU will implement a new program called Import One-Stop Shop (IOSS). An IOSS number allows a seller to collect VAT on their items at the point of purchase which they can then remit to the appropriate EU member country at a later date. This helps packages clear customs borders faster and without collection fees.

In addition to the IOSS implementation, shipments destined to the EU may also be required to include HS tariff codes. At this time, Chit Chats does not require HS tariff codes when creating shipments. Refer to this recent blog post to find upcoming changes to customs requirements that take effect March 1, 2023.

Key Definitions

Here are some important definitions to help you understand the upcoming changes:

- The Value Added Tax, or VAT, in the European Union is a general and broadly-based consumption tax assessed on the value added to goods and services. It applies more or less to all goods and services that are bought and sold for use or consumption in the European Union.

- The Import One-Stop Shop (IOSS) is an electronic, centralized portal which businesses can use starting July 1, 2021 to comply with their VAT ecommerce obligations. All commercial goods imported into the EU from a third country or third territory will be subject to VAT irrespective of their value. The IOSS allows sellers to pay and report the VAT charged at point of sale for all goods.

- The IOSS allows suppliers and electronic interfaces selling imported goods to buyers in the EU to collect, declare and pay the VAT directly to the tax authorities. Previously, VAT was paid at the time of clearance into the EU.

- The European Union is a group of 27 countries in Europe. If you ship to the EU (Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden), this information is important to your business.

A Breakdown of the EU VAT Changes

Sellers located outside of the European Union need to be aware of two main changes beginning July 1, 2021:

- The removal of the VAT exemption for shipments less than €22 (~$32 CAD)

- All shipments to the EU up to €150 will now be subject to VAT and formal customs clearance

- No changes to VAT and duties on shipments greater than €150

- The introduction of Import One-Stop Shop (IOSS), a streamlined portal to help sellers transition to the new VAT system. In order to use this system, shipments must be:

- Sent from outside the EU at the time of sale

- Less than €150 in total value (even if containing multiple items)

- Not subject to other duties

Online Marketplaces (Amazon, eBay, Etsy, etc.)

If you sell your goods to customers in the EU through an online marketplace like Amazon, eBay or Etsy, the IOSS process will involve the marketplace who facilitates the sale. This makes things easier for the seller as the online marketplace will be responsible for paying any VAT due on the sale instead of the seller.

It’s good to note that most marketplaces will do this by including VAT in the list price of items. For a breakdown of how your online marketplace will implement IOSS, we recommend these resources:

Independent Sellers (Shopify, private websites)

How to Register for IOSS

As an independent seller you can register your business on the IOSS portal of any EU Member State. IOSS registration is not mandatory and non-EU sellers have the option to register in just one EU member state. This helps to centralize their VAT declaration and payments for all EU-bound shipments. However, the applicable VAT rate is the one for the EU Member State where the goods are to be delivered. Read more

Additionally, the level of involvement in the IOSS and upcoming VAT changes varies from one EU member to the next. This may mean differences in fees, process and possible delays in certain countries. We are working closely with our partners and industry leaders for the latest updates as EU members plan to implement these new procedures.

We recommend reviewing the resources available and also speaking with a local tax professional to confirm the requirements specific to your business to ensure that you’re ready for the changes come July 1.

More Support for the EU VAT Changes

While we are always here to support our clients, we can’t offer specific tax or legal advice. If you have further questions regarding tariff numbers we recommend contacting a tax professional.

We are monitoring updates closely as carriers, platforms and others in the industry are still working through the upcoming changes and the impact on shippers. As it stands currently, the commitment from each EU country is different and it is uncertain exactly what delays, if any, will occur.

Please stay tuned to our blog and subscribe to our monthly newsletter if you haven’t already. We will be communicating the latest changes and updates through these channels.