Just as you might run an e-commerce business, Chit Chats is largely based online. Meaning you can create shipments from anywhere, thus saving you time when dropping off your packages. You have two main options for this: creating shipments manually or via import.

Note: This is a part of our Complete Guide to Chit Chats. If you haven’t explored the main page of the guide yet, be sure to click here for comprehensive insights and resources!

Table of Contents

- Creating Shipments Manually

- Importing Shipments

- Descriptions and Values

- Restrictions and Regulations

- Insurance

- Postage Types (Domestic)

- U.S. & International Shipping

Creating Shipments Manually

To create shipments manually in your Chit Chats account, simply click on ‘Create a Shipment’ on the left sidebar:

You will then be prompted to fill out all the applicable fields regarding the recipient, description dimensions, package, and postage. Keep reading to learn more about each category.

Relevant Articles:

Importing Shipments

Selling on e-commerce platforms like Shopify, eBay, or Etsy? You can streamline the process by importing your unfulfilled orders directly onto the Chit Chats platform. This saves time by skipping multiple manual steps.

Keep in mind that not all e-commerce platforms transmit the same information to Chit Chats. For a complete list of compatible store integrations and the details they share, click here. If you frequently ship similar products, you can create presets for details like dimensions, descriptions, and more to make quick edits after import. Learn about the two types of presets—shipment presets and line-item presets—here.

Alternatively, you can import shipments via CSV or API, which offers you the most flexibility. For detailed instructions, refer to the applicable articles.

Once integrated and ready to import, simply select ‘Import Shipments’ from the left menu bar to get started.

Relevant Articles:

Descriptions and Values

Accurate descriptions are essential for smooth logistics. They help customs, our partners, and you track and identify the contents of your shipment. For international shipping, detailed descriptions are not just helpful—they are mandatory to meet customs requirements. It’s important to note that all descriptions, no matter the destination, must be in English.

When describing items, generic terms such as “clothing” are insufficient. Instead, include key details such as quantity, color, material, and intended use or gender. Examples of clear and acceptable descriptions include:

- 1 black unisex cotton T-shirt

- 1 gold-plated unisex ring

- 1 original sketchbook

- 1 pack of lavender body oil

Visit here for a more in-depth look into descriptions.

When declaring the value of your package, it is essential to use the sold value rather than the wholesale value. Wholesale values are not accepted because they do not accurately reflect the value of the items and are business to business transactions; this is important for other aspects such as insurance claims.

- Within Canada: The maximum value limit for shipments is 2,500 CAD.

- To the U.S. and international destinations: The maximum value limit is 800 USD.

For shipments to the U.S. and other countries, the 800 USD limit applies to multiple packages sent to the same recipient.

Important:

At this time, gifts shipped to the U.S. are not exempt from tariffs due to our current method of entry. We are actively exploring alternative options. Learn more

Reminder: All Chit Chats International Tracked shipments are treated as merchandise for customs purposes.

Example:

You would like to send 2 packages to John Doe on the same day.

- Shipment 1: $300 USD

- Shipment 2: $600 USD

- Combined Value: $900 USD

Since the combined value exceeds the $800 USD limit, it is considered overvalued, which will result in delays or penalty fees.

To avoid exceeding this threshold:

- Send shipments to the same recipient on separate days.

- Ensure the combined value of packages to the same recipient stays below $800 USD.

Always declare the sold retail value for your shipments; this is essentially the value on the invoice that indicates how much the order was sold for (including discounts). U.S. customs may conduct random checks to verify declared values and could consult your e-commerce listings or invoices. Misrepresentation of values can lead to penalties, delays, or returned shipments.

Relevant Articles:

Restrictions and Regulations

Carriers and services have restrictions. For example, Chit Chats International utilizes air transportation and therefore must adhere to TSA (Transportation Security Administration) restrictions. TSA restrictions involve prohibiting ‘dangerous goods,’ which include flammable items (ex. alcohol-based perfumes) as well as a limit on batteries and products that include batteries.

In addition, all shipments heading to other countries must comply with customs regulations, such as FDA regulations. For example, items such as food, medical products, and organic materials are prohibited for international shipping through our services.

Note: All shipments originating from Atlantic Canada and Alberta are transported via air and must comply with TSA regulations.

Relevant Articles:

- What can’t I ship?

- Can I ship batteries with Chit Chats?

- Are there weight or dimensional limits for my shipment?

- What are the restrictions specific to my carrier?

- Can I send gifts through Chit Chats?

Insurance

Once your packages are measured, weighed, declared accurately, and any required supplementary documentation is included, you may have the option to purchase Chit Chats Insurance depending on the postage type and destination.

While we take pride in delivering packages efficiently, the logistics industry can sometimes be unpredictable. To safeguard against potential loss or damage, we strongly recommend purchasing Chit Chats Insurance for added peace of mind.

- Coverage Includes (up to the limit):

- The total value of your shipment. (Claims will be given in USD)

- Postage fees.

- Note: The insurance fee itself is not covered.

- Exclusions:

- Certain items, such as collectibles and documents, are not covered.

- Partially tracked U.S. shipments are ineligible for Chit Chats insurance.

- Exception: Chit Chats U.S. Slim

- Coverage Limits:

- Up to $800 USD for fully tracked shipments to the U.S. and Canada.

- Up to $50 USD for Chit Chats Slim and U.S. Slim shipments.

- Up to $300 USD for all international shipments.

For details such as the waiting period to file a claim or to view pricing, please refer to the resources below.

If you choose not to purchase Chit Chats Insurance, certain services include a complimentary insurance, Carrier Insurance, through our partners. Typically, the maximum is $100 USD for the applicable U.S. services and $100 CAD for the domestic services. This coverage is available for the following:

- Chit Chats Canada Tracked

- Select U.S. services

- Third-party Canpar pickups

- Maritime Bus Drop Spot locations

For more details about Carrier Insurance coverage, eligibility, and terms, refer to the resources below.

Relevant Articles:

- Is my shipment eligible for Chit Chats Insurance?

- How much does Chit Chats Insurance cost and what does it cover?

- How do I file a claim for Chit Chats Insurance?

- How long will it take to receive my claim?

- Is my shipment insured by the carrier?

- How do I file a claim for carrier insurance?

For additional resources regarding insurance, visit this folder: Folder: Insurance

Postage Types (Domestic)

Once your shipment is ready, it’s time to select the postage type that best suits your needs. The services available depend on the package type (e.g., thick envelope or parcel) and destination. Below is a comprehensive summary of the available postage options to Canadian addresses.

| Destination | Package Type | Services Available | Notes |

| Canada | Thick Envelope | Chit Chats Slim | *Partially Tracked |

| Thick Envelope Parcel | Chit Chats Select | *Unavailable to PO boxes and some rural destinations | |

| Chit Chats Canada Tracked |

U.S. & International Shipping

While the categories listed above also apply to shipments to the U.S. and other international destinations, the categories below are specific to U.S. and international shipments. Each section header will indicate whether it applies to one or both shipment types.

Need Quick Information on U.S. Shipping?

- Guide to U.S. Shipping Compliance

- DDP Solutions: Duties, Tariffs & HTS Codes

- Understanding CUSMA Certification with Chit Chats

- Country of Origin & Manufacturer

Invoices (U.S. & International)

All U.S. and international Chit Chats shipments must pass customs borders. Due to the specific processes involved, an invoice may be required. To avoid potential delays, we recommend always including an invoice with your shipment. Customs agents may do random checks to verify the declared value of your items; having an invoice will expedite the verification process.

Here are the specific instances where an invoice is mandatory:

- Shipments valued at $300 USD or more: An invoice is required.

- Collectibles: Items like sports cards, Pokémon cards, collectible comic books, or any other items with values that are difficult to determine require an invoice, even if their value is below $300 USD.

- Gifts: All gifts must include an invoice.

- Shipments to U.S. Amazon FBA Fulfillment Centers: An invoice is necessary, and additional details are required. Learn more about what’s needed here.

- Note: Shipping to Amazon FBA centers is currently suspended.

For most shipments (excluding Amazon FBA), your invoice should contain the following details:

- Shipping address

- Billing address

- Item(s) sold

- Amount paid: Must reflect the sold value.

- Method of payment: Indicate whether it was by credit card, cash, cheque, etc.

If you sell through an e-commerce platform like eBay, Shopify, or PayPal, you can easily generate an invoice from the order page. These invoices include all the necessary information for customs.

We strongly recommend attaching the accompanying invoice to the outside of your parcel for easy reference, especially for shipments destined for non-U.S. international locations. This ensures customs officials can quickly access the necessary documentation, helping to streamline the clearance process.

For shipments to Amazon FBA warehouses, it is required to be on the outside of the parcel, no exceptions.

Relevant Articles:

- Does my shipment need an invoice?

- What should I include on my shipment invoices?

- Can I ship to Amazon FBA warehouses?

COO: Country of Origin (U.S.)

In 2025, the United States administration had removed de minimis entry, which means:

- All shipments, unless otherwise specified, are now subject to duties and tariffs when heading to the U.S.

- The amount charged depends on several factors, beginning with the Country of Origin of each product.

The Country of Origin (COO) refers to where your product was manufactured, NOT the country it’s shipped from.

Here’s how to identify it:

- Look for a tag, label, or engraving that says “Made in [Country]”.

- If your product is handmade, the Country of Origin is where substantial transformation occurs (for example, where raw materials are turned into the finished product).

- For detailed guidance, visit our support article on identifying the Country of Origin.

Once you’ve determined the Country of Origin:

- Physically mark each product with this information (e.g., engravings, or tags).

- Remember: Shipments may be randomly reviewed by U.S. Customs and Chit Chats, so clear and accurate markings are required.

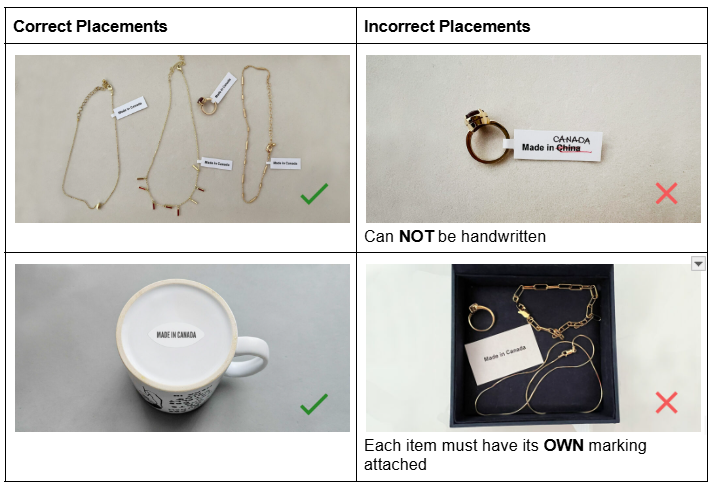

- Below are examples of acceptable markings:

While not mandatory, including or keeping handy supporting documentation helps reduce delays should there be any doubts about the Country of Origin.

If your products didn’t originally have a “Made in [Country]” marking, maintain backup documentation such as:

- A Self-Certificate of Country of Origin (especially for handmade goods)

- Invoices or other shipment documents attached to the outside of your parcel that indicate the Country of Origin

Relevant Articles:

- How do I figure out the Country of Origin for each product I want to ship to the U.S.?

- How do I physically label and provide proof of Country of Origin for my products?

DDP Postage, HTS Codes, & U.S. Tariffs (U.S.)

All shipments to the United States currently require Delivery Duties Paid (DDP) postage.

This means you must pay all applicable duties and tariffs before postage can be purchased.

Our U.S. postage options include:

- All USPS services (e.g. Chit Chats U.S. Edge, USPS Priority, etc.)

- Chit Chats International Tracked (for shipments bound for the U.S.)

To understand the differences between these postage options, please refer to the Postage Types section below.

Duties and tariffs are determined based on:

- The duty rate listed in the official U.S. Harmonized Tariff Schedule (HTS),

- The declared value of your goods, and

- The Country of Origin of each product.

Because these factors directly affect your duty rate, it’s essential to include a valid HTS code for each item in your shipment. An HTS code (Harmonized Tariff Schedule code) is a standardized numeric identifier used to classify the products entering the United States.

Each HTS code determines:

- The applicable duty rate, and

- Whether the item qualifies for preferential treatment

Here are some recommended tools to help you identify your HTS code:

- U.S. HTS Search: The official source for U.S. import classifications. It’s strongly recommended to use this tool once you’ve identified your HTS code to verify whether your product qualifies for duty-free treatment.

- Chit Chats’ HTS search tool: Another user-friendly tool to help you verify your HTS code.

- Canadian Tariff Finder: A user-friendly tool that can be a great starting point.

For a more in depth look into discovering your HTS codes for your products, click here.

Note: While we strive to provide the most accurate tariff estimates possible, these fees are determined by the U.S. administration and our customs broker; therefore, they may change without notice. As such, all tariff calculations are estimates only.

Relevant Articles:

- How do I figure out the HTS code for my shipments?

- What are Duties, Tariffs and How are They Calculated?

- What are DDU and DDP postage types?

CUSMA (Canada-U.S.-Mexico Agreement) & Duty-Free Products (U.S.)

After using the official U.S. HTS Search, you may notice that your product displays an S or S+ in the Special Rate column, or Free in the General Rate column. If your product’s Country of Origin is Canada, the U.S., or Mexico, it may qualify for CUSMA benefits.

Note: Products classified as informational materials are exempt from reciprocal tariffs, regardless of origin or CUSMA certification. No CUSMA application is required for these goods. For details, see the CBP FAQ definition of informational materials here.

CUSMA (Canada–United States–Mexico Agreement) is a free trade agreement that replaced NAFTA in July 2020. It offers preferential, duty-free treatment on goods that meet specific rules of origin, which determine how much North American content is required for a product to qualify.

Note: CUSMA-approved products are not eligible when shipped through Chit Chats International Tracked to the U.S. These shipments will still be subject to applicable tariffs. To benefit from the CUSMA agreement, you must use USPS-based DDP postage options such as Chit Chats U.S. Edge or Chit Chats U.S. Select.

If your product qualifies under CUSMA, it is not subject to tariffs (unless reciprocal tariffs apply). To take advantage of these benefits, you must certify your products for CUSMA within your Chit Chats account.

Follow the easy to follow step-by-step process here.

Important: CUSMA-eligible products shipped before certification are not eligible for tariff refunds.

Always confirm your CUSMA eligibility before shipping.

Relevant Articles:

Manufacturer Information (U.S.)

If you plan to use any USPS postage options for shipments to the U.S., you’ll need to provide manufacturer information for your products. This refers to the details of the company or facility where your products were made. U.S. Customs requires this information to process and clear your shipments at the border.

Here’s how you can find or confirm this information:

- If you buy directly from the manufacturer: The required details may already appear on your invoices, website, packing slips, or other provided documents.

- If you buy from a reseller, distributor, or third-party vendor: They may be able to provide the manufacturer’s details upon request.

If obtaining this information is challenging, you can choose to ship using Chit Chats International Tracked (U.S. bound) instead, as this service does not require manufacturer information for customs clearance.

Relevant Articles:

Country Specific Requirements and Tax Reference Numbers (International)

When shipping to international destinations, some locations require more than just an invoice. Ensuring you include the necessary documentation can help prevent delays and ensure smooth delivery.

For certain destinations, including Spain, the recipient’s phone number or email address is required. This information enables the local post office to contact the recipient and facilitate a successful delivery.

Additionally, a Harmonized System (HS) code is mandatory for all international shipments. These are standard numerical codes used by countries in order to classify the contents of your package.

Shipping to countries in the European Union (EU), the United Kingdom (UK), and Norway involve their own set of requirements:

- GPSR Compliance: Ensure your products are compliant with the GPSR (if applicable).

- Note: Chit Chats is not affiliated with GPSR compliance. It is your responsibility as a seller/manufacturer to meet the requirements.

- Customs Tax Reference Number (Optional)

- IOSS Number (EU): The Import One-Stop Shop (IOSS) number indicates that VAT (value-added tax) has already been paid by the recipient.

- VAT Number (UK): Similar to the IOSS, the VAT number is used for shipments to the UK.

- VOEC number (Norway): Similar to the IOSS, VAT on E-Commerce (VOEC) is used for shipments to Norway.

Including the applicable tax reference number in the customs declaration indicates your recipient should not be assessed duties or fees upon delivery. If the IOSS/VAT/ VOEC number is not included, it will be the responsibility of the recipient to pay the custom and duty fees for the shipment.

For shipments using Chit Chats International (to Europe), you can take advantage of the tax reference numbers, which prevents the recipient from paying taxes for a seamless customer experience. However, note the following value limits:

- UK addresses: Maximum value of $220 CAD*

- EU addresses: Maximum value of $215 CAD*

- Norwegian addresses: Maximum value of $380 CAD*

*Subject to currency exchange fluctuations.

In other words, your recipient won’t be charged duties on the shipment as long as you include the tax reference number AND the shipment value remains within the applicable limits.

Different countries may have unique requirements. While this is not an exhaustive list, here are a few examples—other locations may have additional requirements:

- Brazil: CPF or CNPJ number

- South Korea: Personal Customs Clearance Code (PCCC)

It is your responsibility to ensure all required documentation is included when shipping internationally. Failure to do so can result in delays or your package being unretrievable.

For detailed guidance, refer to our dedicated article here.

Relevant Articles:

- What customs information do I need to provide?

- What are DDU and DDP postage types?

- What is the GPSR and do you need a representative?

Postage Types (All Destinations)

Once your shipment is ready, it’s time to select the postage type that best suits your needs. The services available depend on the package type (e.g., thick envelope or parcel) and destination. Below is a comprehensive summary of the available postage options:

Each service comes with its own minimum and maximum dimension and weight requirements, along with distinct benefits.

For a comprehensive overview of your postage options and requirements, refer to the linked folder.